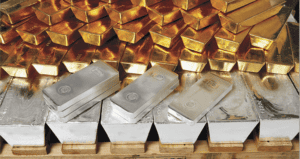

Gold prices in India surged on May 10, 2024, coinciding with the auspicious occasion of Akshaya Tritiya 2024, amidst heightened demand in the spot market. The cost for 10 grams remained steadfast, hovering near Rs 73,090. A comprehensive market analysis revealed that the average price for 10 grams of 24-carat gold approximated Rs 73,090, while 22-carat gold averaged around Rs 67,000. This represents a [X%] increase from the previous month. Simultaneously, the silver market demonstrated an upward trajectory, reaching Rs 86,500 per kilogram, which is [X%] higher than the previous week.

Today’s gold rates in India showcased regional variations:

In Delhi, as of May 10, 2024, the prevailing price for 10 grams of 22-carat gold was approximately Rs 67,150, whereas 10 grams of 24-carat gold commanded around Rs 73,240.

In Mumbai, the price of 10 grams of 22-carat gold stood at Rs 67,000, while the equivalent amount of 24-carat gold was valued at Rs 73,090.

In Ahmedabad, the price for 10 grams of 22-carat gold was Rs 67,050; the same quantity of 24-carat gold amounted to Rs 73,140.

The Multi Commodity Exchange (MCX) was a hub of dynamic activity on May 10, 2024, particularly in gold futures contracts expiring on June 5, 2024, priced at Rs 72,232 per 10 grams. This active trading, reflecting the dynamic nature of the gold market, keeps investors and traders on their toes. Silver futures contracts expiring on July 5, 2024, were quoted at Rs 85,370 on the MCX, further indicating the market’s vibrancy.

Gold prices experienced a global surge, increasing by 0.37%, reaching $2,355.50 an ounce in New York. This international trend had a ripple effect on the Indian market. Silver prices also ascended by 0.39%, settling at $28.51 an ounce.

The retail price of gold in India, colloquially known as the gold rate, represents the ultimate cost per unit weight customers bear during gold purchases. This price is influenced by myriad factors beyond the intrinsic value of the metal itself, such as global economic conditions, geopolitical tensions, and the strength of the Indian rupee against the US dollar. Similarly, silver prices are influenced by factors like industrial demand, investor sentiment, and supply and demand dynamics.

Gold holds immense significance in India due to its cultural eminence, appeal as an investment avenue and time-honored role in weddings and festivals. It is not just a precious metal but a symbol of wealth, prosperity, and purity. In India, gold is often bought and gifted during festivals and weddings, and it is also a popular investment choice, especially during times of economic uncertainty.